This week I bought something! On Monday YRL came out of a trading halt and reported 78m at 1.2 g/t Au from 96 m to EOH. This is certainly not the normal sort of Greenfields discovery I hope for, and I downplayed the result at first, but ultimately came to appreciate the significance.

Most of this weeks post is dedicated to this discovery and there’s are a couple of honorable mentions.

In my attempts to reach more people with these posts I would like to request readers give me a share if they are getting value out of the material.

The Tracker

ENR drilling at Sandover

GCM drilling at Boulia (Drilling completed awaiting assays)

Follow ups

None

New interesting targets

Yandal Resources-YRL- RC drilling returns 78m @1.2g/t from New England Granite

I will be the first to admit that I generally pay less attention to companies exploring for orogenic gold. This is true for Western Australia as much as for any other part of the world and the reason is quite simple. If you want to be a superstar in orogenic systems you have to be across, and love structural geology. I do not!

In saying that the market loves these discoveries (and so do I). Particularly in WA. The reasons for this are simple. You can put them into production quickly (provided the economics stack up), or if you don’t want to, you can sell it to one of many major or mid-tier gold producers in the state.

This is doubly the case if you make a discovery within 50-60 km of a existing processing plant. A good example of this was NST’s purchase of STK’s tenement package and the 600k odd ounces it contained (over 5 deposits in the Yandal Belt) for 61 million in cash. The world is full of small gold deposits that that no one cares about, but plonk one of these close to a mill in WA and you’ll have some interest.

Yandal’s find is in just such a discovery. Can’t call it big or small yet, but it is within potential trucking distance to number of NST owned plants.

Yandal Resources tenements and New England Granite prospect with respect to the Yandal Belt and operating mines.

Yandal arrived at this hit following some diamond drilling investigating regolith gold anomalies on the eastern and southern margin of the granite, noting fertile structures carrying gold within the granite and speculating that the intersection of these structures with the granite-greenstone contact would lead to favorable structural intersections and economic mineralization.

The MD gives a account of this targeting from about the 10 minute mark here:

It did and they hit 78m at 1.2 g/t Au from 96m.

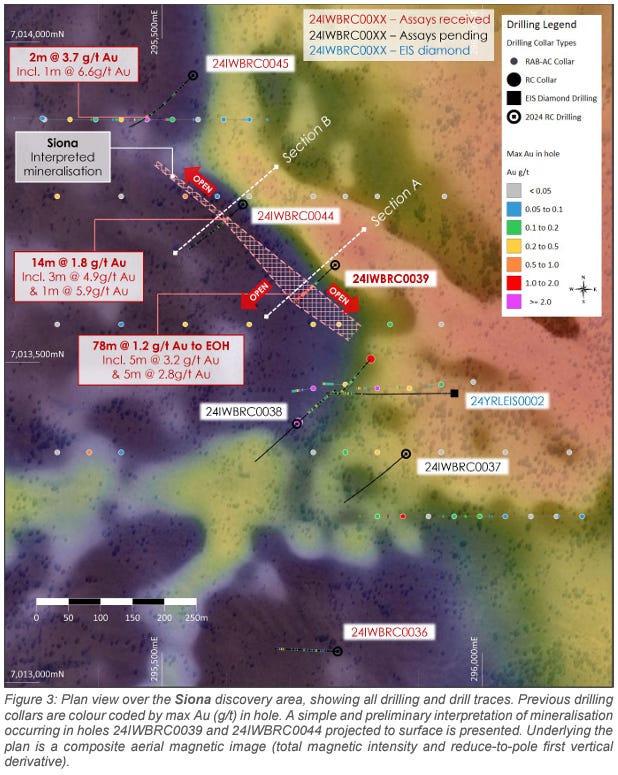

A hole 170 m to the north of this intersection also got 14m at 1.8 g/t Au, and another even further north got 2m at 3.7 g/t Au, although it is not clear that this is part of the same hosting structural intersection.

This is where all the fun of structural geology comes in. The granite-greenstone contact is largely vertical whereas the intersecting shear zones appear to have a shallow dip according to measurements collected from the diamond drill hole that preceded the discovery RC drilling. Although this interpretation may be a product of the cross-section projection. This intersection will have a dip and a plunge, and it may be that better (wider and higher grade) mineralization is to be found below drillhole 44, or not, this is strictly my own speculation.

The takeaway is that this is a nice hit on something that was not drilled previously and the majority of the intersect is in primary mineralization meaning that the tricks that regolith gold upgrading can play are not a factor here.

See the YAM 14 prospect that preceded the Gruyere discovery here for a example of this below.

The 78 m intersection is still open (drilling was terminated as rains filled their sumps) and the company will be going back down the discovery hole to determine the full width of mineralization in 1-2 weeks as of Monday and performing more drilling to work out the geometry and size of the discovery. Very exciting!

I am hoping for a big fat continuous lode with both bulk tonnage as well as high grade targeted development options and lots of ounces along with repetitions of this style of mineralization across the granite elsewhere. We will see.

The company’s MC is higher than I would like but I expect to be paying a premium in WA near processing options. The register is tightly held and management and technical advisors are strong to say the least.

It will be interesting to see if the company raises off the back of this or not. Currently there are some 22 million options (ex price $0.24) that are due to the expire next Thursday and should they all get converter the company could see an extra 5 million come its way. GOR has already done this adding to their 17% holding, whilst at the same time exercising their ex $0.11 options that expire next year.

I watch with interest, and hold an interest.

This is a interview with the MD with released last Friday

Honorable Mentions

A few of interest this week

Norwest Minerals-NWM- West Arunta base metals discovery

CuFe ltd- CUF- West Arunta Land Access Agreement Executed

Legacy Minerals-LGM-Platinum & Palladium Drilling Underway at Fontenoy

Disclaimer

Nothing here is financial advice, comes with no warranty and I take no responsibility for anyone’s financial decisions.

Cheers,

CC