It’s getting to a point in the market where, frustratingly, I am not seeing too many fresh and radical exploration ideas. The ones I am aware of I have communicated to you all here, but the grand visions of mineralized belts under cover or the existence of particular economic deposits in belts where they are not expected i.e. Au in the Pilbara, Porphyries in Victoria, IOCG Carbonatites in the West Arunta, are sorely lacking. Not all of these work out but the ones that do make for discoveries worth owning.

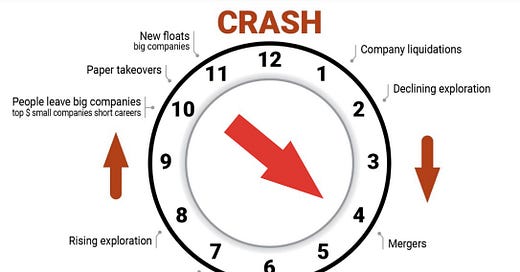

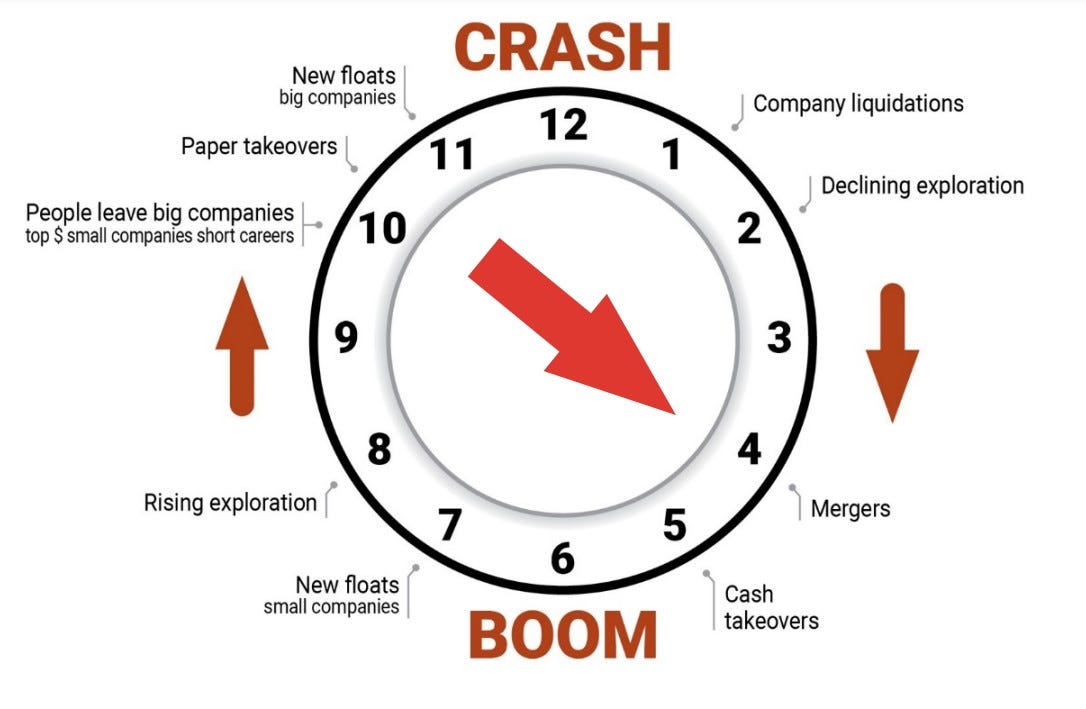

This lack of fresh ideas, along with a few other current trends in the market are telling of where we are in the “cycle”. Some of you may have seen the clock below and how it is used to track the boom-bust nature of the sector.

Lion Investments boom bust clock

Published regularly by the Lion Selection Group (ASX:LSE) and core to their strategy, it is currently sitting at 4 AM (or PM, not sure). I could even place it at 5 given some of the offers seen for CHR, HLX and the Latin Minerals takeover. All very nice and all very positive for the future.

But where do our radical exploration ideas live during this time? In my experience they live in private hands.

This period of time reminds me of 2017-2018 where some drilling companies were happy to drill for 50% equity (because they had to) and raisings got to the point where they were less than the LMI beating 20% deposit required for a average suburban house! Bleak times for the junior market.

While this was happening teams were getting the likes of Adriatic Minerals and WA1 Resources ready for JV’s and floats, along with many others whose radical ideas did not work out or were poorly executed on.

All of this is to say that during these times I pay attention to upcoming floats, ground being pegged or consolidated and new concepts entering the fray through the state and federal geological surveys. It is also the time I think about commodity Beta plays and positioning.

I may cover some of this in future updates, may even start a series.

Critically, next week I will be traveling a fair bit and do not plan on publishing a weekly update unless something very exciting happens. It also conveniently allows me to go from the 12th to 14th weekly update and avoid the bad luck.

Onto the programing.

The Tracker

GAL drilling that 16k S conductor (4th week, may be done by now?)

Assay update from CUS on Douglas Creek hole 2 (Assays expected Oct)

ENR drilling at Sandover

GCM drilling at Boulia (Drilling completed awaiting assays)

Follow ups

Investigator Resources-IVR- Sale of Stuart Shelf JV and Tenements

In a decision that somewhat disappointed me (because I will not be able to track how this exploration plays out) Investigator has sold its minority stake and adjoining tenements to the privately owned Discover Co for 1 million dollars. With this move Discover Co has bought a lot of potential upside and Investigator has sold off a potential discovery but ensured a reduction in carry costs and a concentration of efforts on Silver and the Paris project.

New interesting targets

Ausquest Limited-AQD- Conductive Targets Defined at Mt Davis

This is a very green, very early target that has come about following the discovery of Earaheedy by RTR. Essentially, the Mt Davis tenement takes up a mirror position on the north side of the Earaheedy basin with a fair bit of structural complexity. The exploration rationale is that the same basin wide mineralization event could manifest on the north side as well as the south and produce stratiform Pb-Zn-Cu mineralization.

The company has flown about 1000 km of EM to deliver a number of targets that could be stratiform sulphide and sit in favorable stratigraphic positions below the Frere iron formation.

The company will follow up with ground work that may include further EM and drilling following initial field visits.

I like AusQuest as a company. All of their projects are large undercover conceptual beasts and they are not afraid to step off the map. They have a few other projects that are of interest to me that I intend to cover in the future.

In this case I would not view the discovery of another Pb-Zn deposit of modest grade a success but less is known about this side of the basin and I am looking for indications of copper dominance in the sulphide that would have a potential profound impact on both the economics of any discovery along with its widespread appeal.

Helix Resources -HLX- Upgraded Bijoux Copper Anomaly to be drilled in September

Helix this week announced that they will be drilling the new upgraded northern part of their Bijoux Copper anomaly this month. This prospect has so far produced some intersects that can at best be described as interesting in my opinion.

The prospect lies along trend from the companies Canbelego resource where the mineralization has proven capable of manifesting high copper grades and of being amenable to EM driven exploration.

In the case of Bijoux I am looking for a favorable intersection in terms of width and grade and follow with DHEM that can demonstrate some depth continuity. The copper systems in this part of the world tend to have limited strike extents but can persist for considerable depth. The key is finding enough high-grade material in the top 300-400 meters to justify the investment of a mine which many have failed to achieve.

The company is currently the focus of a takeover bid and I am not certain how a discovery or a good hit will manifest under such conditions.

I watch with interest.

Honorable Mentions

A few of interest this week.

Litchfield Minerals-LMS- Mt Doreen VTEM Survey Reveals High-Priority Targets

Trigg Mining-TMG- Drilling Commences on Drummond Gold-Antimony Project

Lycaon Resources-LYN- West Arunta Heritage Approval Received

Disclaimer

Nothing here is financial advice, comes with no warranty and I take no responsibility for anyone’s financial decisions.

Cheers,

CC