Greenfields mineral exploration and its misperceived risks

Exploration project maturities, risk implications, and common misunderstandings of both

Exploration projects are commonly classified as either Brownfields or Greenfields, but what does this really mean? Are they all either dark brown or ultra-green, are some a little bit brown or do some have green dots?

In this piece I work to demystify these terms, call out their misuse and highlight some companies conducting true Greenfields exploration and why I like them. I also delve into the risk and reward systematics of Greenfields vs Brownfields exploration.

Definitions

We can kick off with a couple of definitions. These come from the Australian house of representatives. The definitions in turn are taken from Geoscience Australia and a document I had no luck locating. Examining the wording we see the interplay of a few concepts primary among them being “Risk” along with terms such as “Remote”, “Unexplored”, “Incompletely explored” and “Near Mine”. I could have used others but ultimately this is fit for the purposes of the article.

Australian government attempts to define Greenfields and Brownfields exploration.

In essence definitions such as these parse out Greenfields exploration into a “high-risk” endeavor conducted in “Unexplored” or “Incompletely explored”, “Remote areas” and Brownfield as “Near Mine” and presumably explored and low or lesser risk?

Definitions such as these misunderstand risk, and leave little room for nuance, but they are functional. I offer a couple of alternatives below and with this attempt try to capture some situations in the definitions that may on the surface appear to be Brownfields endeavors but in reality, are very much Greenfields affairs.

For example, was exploring for nickel near existing gold mines during the 69-70 Nickel boom a Greenfields or Brownfields undertaking? Was looking for lithium on the same ground 40 years later Greenfields or Brownfields? If someone came up with a geophysical technique that could directly detect nickel sulphides to a depth of 1km would this be Brownfields exploration, or would it only be Brownfields to the effective depth of previous geophysical techniques in this same area?

Here is my attempt:

Greenfields exploration- Exploration conducted in search spaces or parts of search spaces where the occurrence of the targeted deposit type and commodity sought has not been proven or extensively tested.

Brownfields exploration- Exploration conducted for extensions or satellites associated with previously defined resources or in search spaces where the targeted deposit type is both proven and explored for.

I’ve often come across mine geologist who have described their infill drilling and resource to reserve conversion as being Brownfields exploration but this does not fit as the orebody has already been discovered and the drilling is done to achieve the necessary precision for mining.

The weakness of these definitions is that it requires the explorer to stipulate their target. But what if we don’t? In that instance we do not possess the requisite bounding parameters to effectively define our targets and as a result the data that needs to be collected.

The Greenfields/Brownfields interplay is affected by the multiple parameters of target commodity, deposit type, previous exploration, proximity to exiting operations (of the same kind) and finally the effective exploration “search space” that the exploration technique being deployed permits. It is important to define the term “search space” credited to Jon Hronsky OEM, of whom I am a big fan.

Exploration Search space

Discussions of the concept can be found here

and HERE

but to summarize the points relevant to the article:

1. Mineral discovery within an area or a volume of rock (search space) progresses from the most obvious and easy to find orebodies being discovered , to those orebodies of increasing difficulty and signal subtlety.

2. As these orebodies are discovered they cannot be discovered again and as a result over time the discovery rate deteriorates. The search space is progressively depleted.

3. To improve the discovery rate a new search space must be found.

Ample evidence of this exists and is given in Hronsky’s paper, such as that of sulphide hosted nickel resources discovered in Western Australia over time. One can very clearly note that post the Nickel boom this search space has seen comparatively little metal found, despite repeatedly seeing price booms since. If one was to do a study of any such belt a similar pattern would emerge.

Amount of Nickel discovered in Western Australia by year in millions of tons of contained metal.

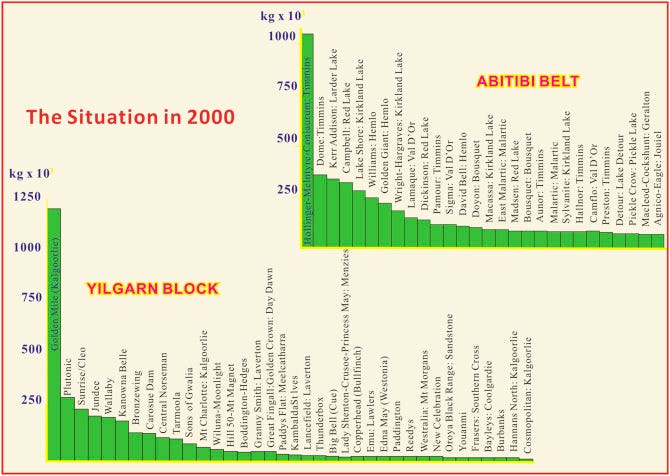

Over time as more and more deposits are discovered in any given belt the characteristic image of a Pareto distribution appears in rank-size distribution plots such as that shown in the image below. Orebody distributions follow power law relationships in the same way other earth phenomena do such as earthquakes and volcanic eruptions. This has become a very important tool in assessing how mature a search space is. This is particularly true given that the largest deposit tends to be discovered first i.e. Olympic Dam, Broken Hill.

Size frequency plot of gold deposits in the Yilgarn Block and Abitibi Belt.

Diagram from (The conjunction of factors that lead to formation of giant gold provinces and deposits in non-arc settings)

In the instance shown of the Yilgarn and the Abitibi belts, we can conclude that they are very mature and the probability of discovering a large 1000-ton Au plus deposit is low.

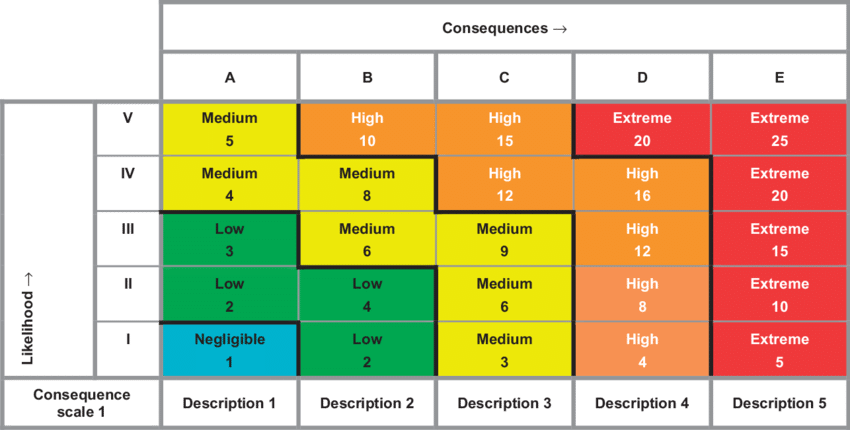

Greenfields vs Brownfields Risk

The definitions we presented earlier attempted to deal with risk and propose that Greenfields exploration in remote unexplored terrains was a high-risk undertaking, but this perception confuses risk with probability. Greenfields exploration carries a low probability of success but to assess its risk we need to view it in not only in probability space but also consider the cost or consequences of an unfavorable and favorable outcome.

Likelihood vs Consequence Risk assessment diagram.

Anyone who has ever done any work in mining would have seen one of these diagrams. They are used to assesses risks associated with performing a task and allow for the recognition, management, and elimination of high-risk steps. These are defined both through likelihood and consequence.

If we consider a Greenfields exploration campaign in Australia, this almost certainly means that we are dealing with an undercover terrain and our exploration campaign will involve the collection of geophysical data appropriate to our deposit model, perhaps some geochemical surveys and ultimate follow up by drilling. When drilling the defined targets, the presence or absence of any mineralization, hydrothermal alteration and economic minerals will be instructive as to the continuation or cessation of work . Encouragement is either present or absent and testing a number of targets allows for a distribution of risk that can be followed by target re-ranking and follow up.

In this scenario a Greenfields exploration campaign can draw on significant pre-competitive data, government co-funded drilling and as a result test many targets for a standard company float raising of some 8-12 million dollars. Provided that ground access is taken care of, and quality geological work done, the finest targets in a large belt can be tested and a discovery can materialize. Although the cost of testing a belt can be high, the cost of each target is comparatively low, particularly when compared with the cost of farming into a advanced project. This is why pre-competitive geophysical data is so valuable and an extremely worthwhile investment that both the state and federal governments undertake. The magnetic, gravity and increasingly MT surveys provide a broad brush pass over extensive areas that few companies are prepared to conduct themselves, narrowing the search space from hundreds to tens of thousands of square kilometers. Often the ground pegged in Greenfields exploration is open and the cost of entry low.

Compare this to Brownfields exploration and the cost of entry to a “Advanced Project” which has sat idle for some time or had multiple attempts at development. Such projects commonly need to improve materially to be brought to a state of economic appeal. A future piece will examine some that have seen this done successfully through the deployment of ore sorters, but they are rare and in many cases a whole new deposit and order of magnitude better needs to be defined as was the case at Fosterville.

I realized through writing this that despite being a close study of successful discoveries I lack a detailed collection of failed Brownfields farm-ins and mine restarts. Fortunately, these are so abundant that it is not hard to list a bunch off: Avebury mine restart failure, Abra mine development failure, and the best of all the Hillgrove Au-Sb mine in NSW.

How’s this volley of headlines!

Wowzah!!

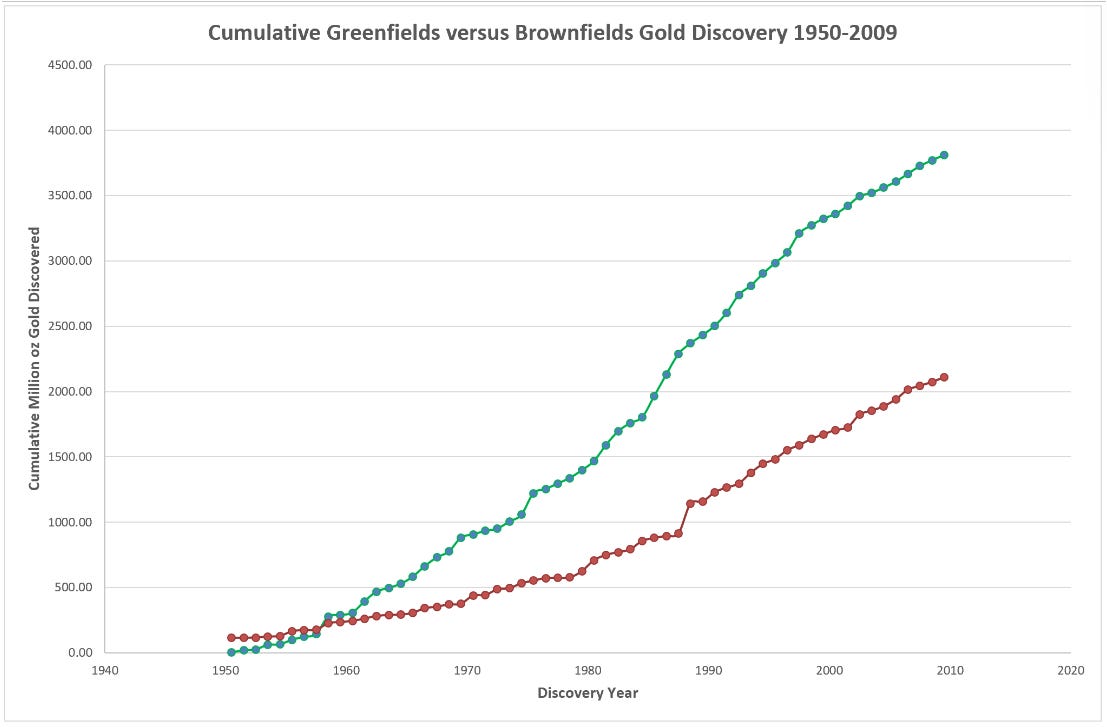

Ultimately, these examples are different from the likes of Goldfields or Northern Star adding near mine ounces to an existing operation and there are examples of Brownfields discoveries that work but ultimately these are rarely as large or as appealing from a returns perspective as Greenfields discoveries. Studies of the efficacy of Brownfields vs Greenfields exploration are sparse but for the few datasets that exist the work of Richard Shodde stands out, here via a review of his work:

Cumulative ounce of gold discovered since 1950 split between Greenfields and Brownfields sources.

The plot clearly demonstrates that Greenfield discoveries account for the majority of ounces added over time. A further interesting plot would be that of the discovery cost per ounce. My strong suspicion is that the Greenfields discoveries come with much lower costs although I am unaware of a dataset to support this.

Risks in Greenfields explorer investing

In-spite of these findings the Greenfields vs Brownfields debate must be considered from the position of the personal investor not the market overall. It is important to state here that a strategy of holding shares in all the great Juniour Greenfields explorers out there would be excessively dilutive on a portfolio level and the very nature of their need to raise via equity issuance would see this investment reduced over time. Ultimately, holding some but otherwise waiting for a discovery to a) be made and b) be confirmed as being of possible scale and quality before acting results in the absolute minimization of risk and the maximization of capital deployment. It also provides ample opportunities to exit provided that early encouraging result are not followed up by similarly impressive intersects. I will do a piece on how to recognize genuine discoveries in the future.

Despite the excitement that a exploration campaign brings and no matter how good a target looks the most likely outcome of each drill hole will be a non-discovery.

The Greenfield explorers I keep track of

It is important to note that this is not an exhaustive list and there are other companies that I will cover in a follow up posts. CUS is another but I covered it in the article here already:

How to sell a copper deposit

This piece is primarily concerned with determining if an exploration campaign is worth pursuing. The concept is explored through the particulars of the copper market and BHP’s control of South Australian production, its speculated expansion plans and the IOCG (Iron-Oxide-Copper-Gold) deposit types metallurgical characteristics.

PTR- Petratherm

The companies name is a legacy of its previous pursuit of geothermal power in South Australia. This ultimately never panned out but was the source of quite a bit of excitement some 10-15 years ago. Currently, they are on the hunt for IOCG’s in South Australia with two key sets of tenements and some REE in clay projects that are of little interest to me. Management is of a significant caliber with Derek Carter being the other Explorer of the year co-recipient alongside Tony Belperio for the Prominent Hill discovery and Peter Raid who also participated in it.

Petratherms tenements and projects.

The Woomera tenements are peripheral to the BHP’s big copper mines and the company has worked to build these up to a drill ready state with a recent presentation giving a pretty good explanation. Plans are to drill these in the 3rd-4th quarter of 2024 but with 1.4 mill in cash I expect a capital raise.

Petratherms Woomera project- The project has some very compelling IOCG targets.

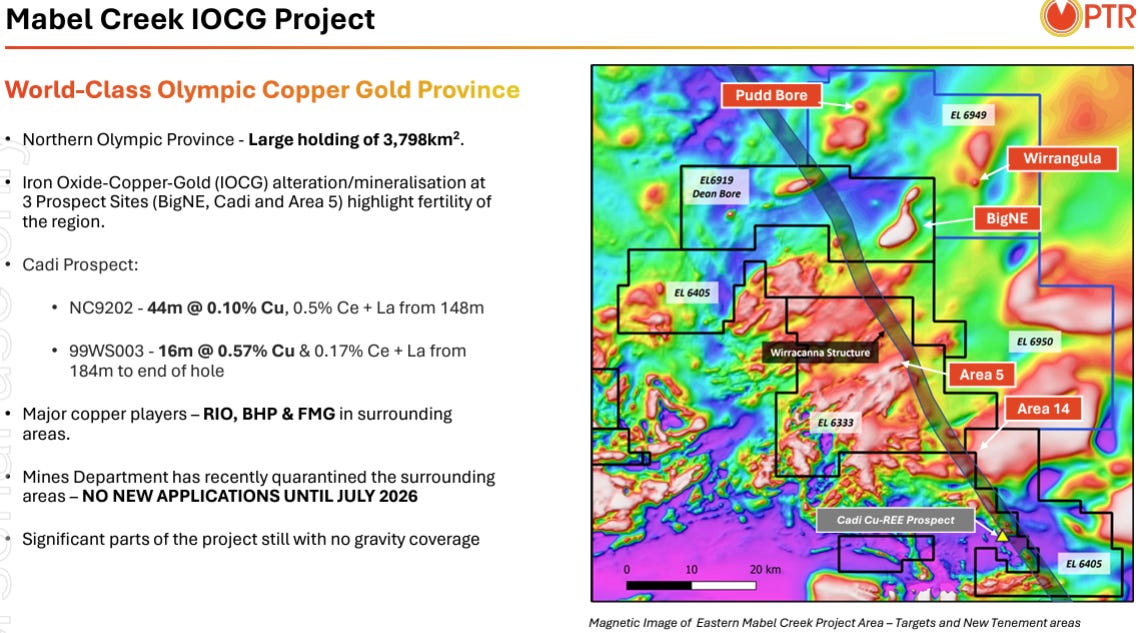

The other set of tenements of interest is the Mabel Creek cluster. Here there are plenty of gravity and magnetic anomalies worth investigating along with lots of hydrothermal iron alteration as one would expect to see in a IOCG terrain and even some copper intersected as well. The project has much less proven prospectivity as compared to the Woomera EL’s but nevertheless caries the potential for discovery. Q4 for expected drilling.

Petratherms Mabel Creek project.

CGR-CGN Resources

I am not familiar with CGN Resources management history but they are largely scientists and mining professionals. The company was one of the early tenement peggers in what has become the very fashionable address of West Arunta even preceding some of the Agrimin/Tali/WA1 pegging that led to the Luni discovery.

CGN Tenements and surrounding area. Note the take up of ground in the period.

The companies targets were originally IOCG’s and Orthomagmetic nickel sulphide deposits. Recently, carbonatites have been included in the list as well. There is some historical drilling in this are with high Ni in ultramafics and a reported IOCG copper prospect on the adjacent Tali/Rio JV tenement. The company has 7 million in cash and is actively drilling and exploring.

Horton and Snorky gravity image (left) and IP transects (right).

Of particular interest are the Horton and Snorky prospects that are coincident Gravity/IP anomalies. The chargeability tops out at 15 mV/V which is not particularly high but one could argue that sulphides hosted in resistive hematite alteration could manifest this way.

Since the company is relatively new and their tenements poorly explored there is not much to speculate on other than that they are a significant landholder in a large unexplored terrain that has given up at least one Tier 1 deposit so far.

LGM- Legacy Minerals

Legacy has been a very interesting one to watch in how they have expanded their footprint of exploration projects and how over time they have acquired more and more conceptual Greenfields targets.

The company listed in 2020 with a young looking managing director in Thomas Wall who along with another director Matt Wall (relation unknown) held some 30% of the company. This is always good to see as directors interests are aligned with shareholders. Of the multiple projects the company floated, the Harden gold mine was the focus of early exploration. It looked like a thin bit of poddy mineralization in someone’s backyard that given the companies otherwise very good ground selection might of been a “listing project”. Once they performed the work outlined in IPO they moved on from it to the Bauloora epithermal project.

Historic Harden gold mine.

The company describes the Bauloora epithermal field as the largest in NSW with abundant epithermal textured quartz veins, some with visible gold and an old gold mine. This seemed to be good enough for Newmont who farmed into it allowing the company to focus on their Black Range (low-sulphidation epithermal Au-Ag) tenements with the remaining IPO carried ground at the Fontenoy Project (Orthomagmatic Ni-Cu-PGE) also being farmed out. The Cobar tenements remained with the company.

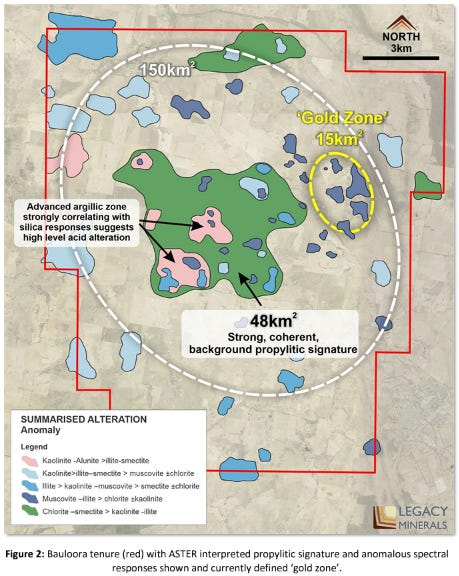

Bauloora epithermal field as defined through satellite based hyperspectral mapping.

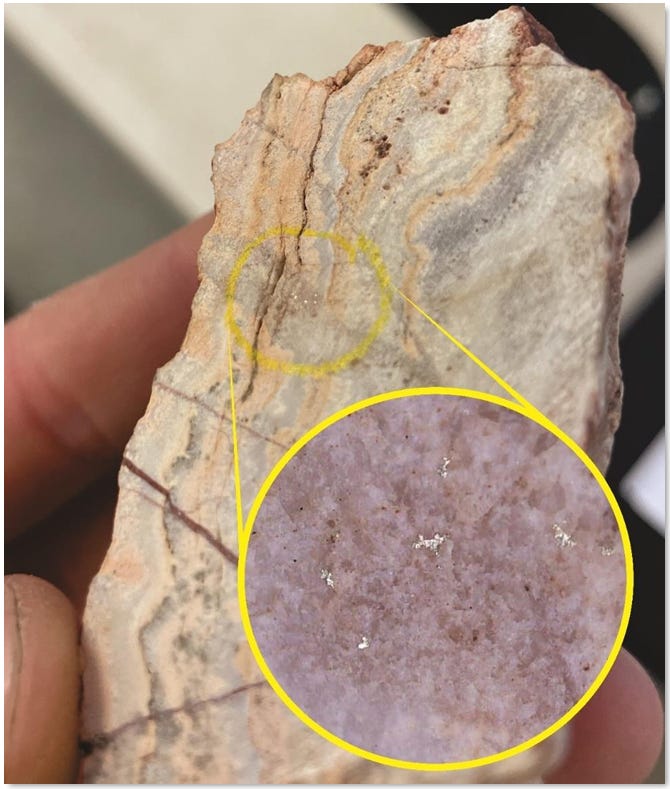

Examples of coliform banded low Sulphidation epithermal veins from Bauloora.

The company has been picking up lots of additional ground in the past year in the form of Mt Carrington (low-sulphidation epithermal Au-Ag + Cu), Cowra Cu-Au porphyry prospect that’s been given a big stamp of approval by Mark Bennet’s S2 Resources farm in and appears to be a extremely large target along with the very large Thomson Project. All projects excluding the former are outlined in this presentation Targeting High-Value Discoveries.

I am particularly impressed with the Cowra target and the Thomson ground.

Cowra magnetic anomaly .

Geological map of the Cowra target.

The Thompson project on the other hand was acquired from Eastern Metals (EMS) who appear to have had a rocky couple of years and is a very large undercover package in the Thomson Orogen, a geological area often compared with the Lachlan Orogen. Here the company has an abundance of magnetic targets interpreted to represent magmatic-hydrothermal centers with the possibility of hosting Cu-Au porphyry or Intrusion Related Gold Deposits (IRGS) with encouragement already observed at several of the prospects.

Thompson project tenements and magnetic anomalies.

Evidence of hydrothermal activity at some of the Tomson Project anomalies.

Closing remarks

When putting this article together I wondered if the inclusion of individual companies or their projects was appropriate as it would ultimately date it but then I realized the inclusion would allow the reader to follow exploration on these targets themselves and place into context the principles described here. It would also provide for the very interesting opportunity of following up on them in lets say a years time to either describe the discoveries made, or much more likely how the targets presented manifested themselves as false positives. It also provides an introduction to a series of regular articles that will highlight Greenfields explorers and their targets.

Finally, a repeat of the disclaimer, nothing here is financial advice, comes with no warranty and I take no responsibility for anyone’s financial decisions.

Cheers,

CC

Quite insightful we in India have started using geophysical data but as a geologist aren't very proficient or better say confident in targeting based on these geophysical signatures. Can u suggest some discussion which can I read which give practical idea to convince myself and higher ups on how one should proceed to target based on these data.